south dakota vehicle sales tax calculator

For an exact price select Interested in vehicle registration during signup and our specialist will contact you. Average DMV fees in Missouri on a new-car purchase add up to 63 1 which includes the title registration and plate fees shown above.

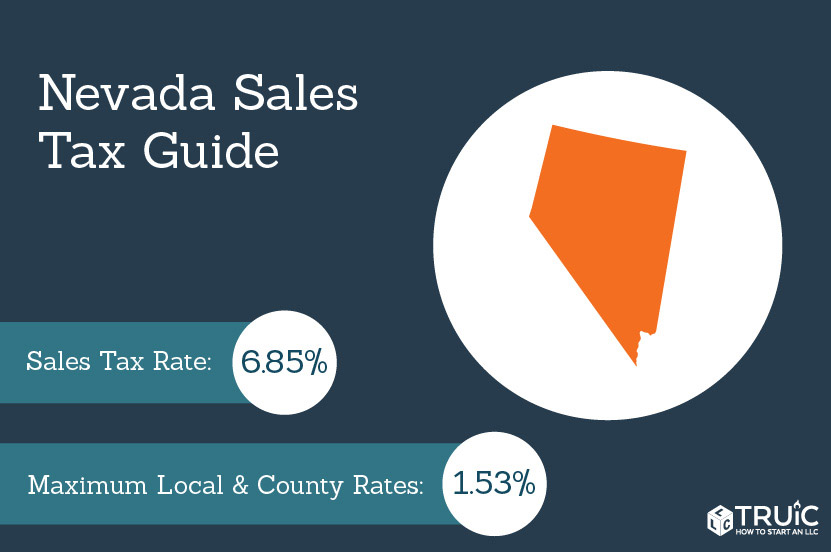

Nevada Sales Tax Small Business Guide Truic

10 years old or older.

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

. 0 for electric vehicles. New car sales tax OR used car sales tax. The South Dakota Department of Revenue administers these taxes.

The highest sales tax is in Roslyn with a combined tax rate of 75 and the lowest rate is in Buffalo and Shannon Counties with a combined rate of 45. Review and renew your vehicle registrationdecals and license plates. They may also impose a 1 municipal gross receipts tax MGRT that is in addition to the municipal sales tax.

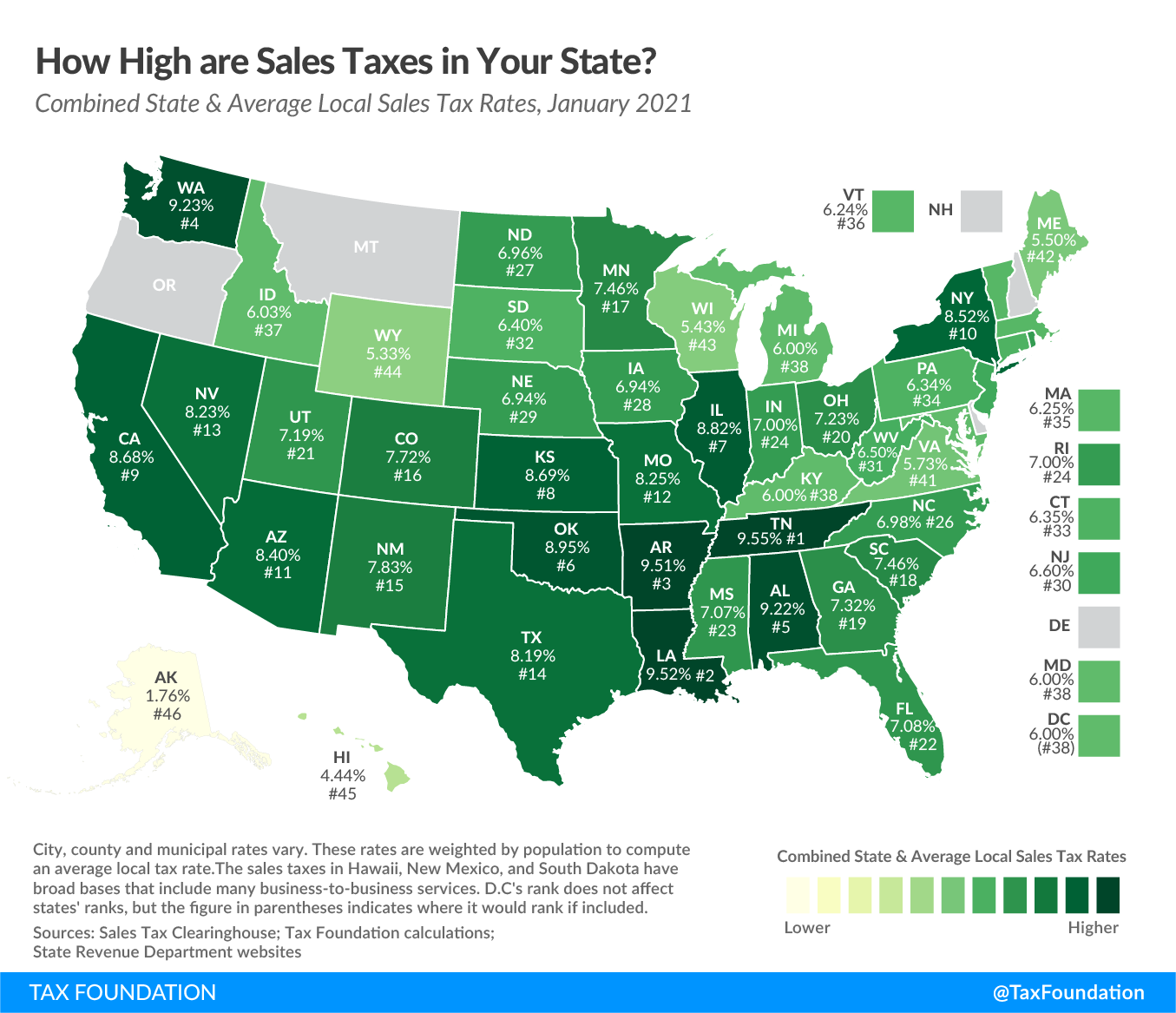

To calculate the sales tax on a. 2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation. South Dakota has recent rate changes Thu Jul 01 2021.

The Motor Vehicle Division provides and maintains your motor vehicle records. South Dakota Sales Tax. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

The vehicle is exempt from motor vehicle excise tax under SDCL 32-5B-2. 150 for echeck or 225 for debit or credit card. Registration fees in South Dakota are based on the type age and weight of the vehicle.

Non-commercial vehicles weighing up to 4 tons. Our online services allow you to. The county the vehicle is registered in.

Whether or not you have a trade-in. The type of license plates requested. The average sales tax rate on vehicles across the state is.

Motorcycles under 350 CC. Thursday June 9 2022. Sales Tax Rate s c l sr.

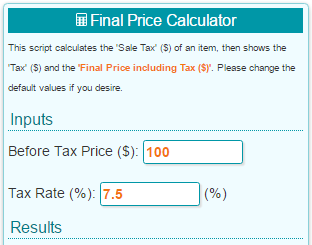

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Municipalities may impose a general municipal sales tax rate of up to 2.

Actual cost may vary. Please select a specific location in South Dakota from the list below for specific South Dakota Sales Tax Rates for each location in 2022 or. South dakota vehicle sales tax calculator.

Purchase new license plates. Costs include the registration fees mailing fees mailing fee is 1 for each registration renewed and a processing fee. This includes the following see.

Sales Use Tax for Remote Sellers. South Dakota has a 45 statewide sales tax rate but also has 289 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1814 on. A remote seller is an out-of-state retailer that has no physical presence in South Carolina.

Find out the estimated renewal cost of your vehicles. Law enforcement may ticket for driving on expired plates. Your household income location filing status and number of personal exemptions.

United States vehicle sales tax varies by state and often by counties cities municipalities and localities within each state. Fees to Register a Car in SD. 4 Motor Vehicle Excise Manual.

How to Calculate Sales Tax on a Car in South Dakota. The state sales and use tax rate is 45. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

The municipal gross receipts tax can be imposed on alcoholic beverages eating establishments. Car sales tax in South Dakota is 4 of the price of the car. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to South Dakota local counties cities and special taxation districts.

Car sales tax in South Dakota is 4 of the price of the car. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. Its important to note that this does include any local or county sales tax which can go up to 35 for a total sales tax rate of 75.

All car sales in South Dakota are subject to the 4 statewide sales tax. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. A remote seller is an out-of-state retailer that has no physical presence in South Carolina.

SDL 32-5-2 are also exempt from sales tax. South dakota vehicle sales tax calculator Thursday June 2 2022 Edit. - All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under.

How to Calculate Sales Tax on a Car in South Dakota. Tax and Tags Calculator. North Dakota has a 5 statewide sales tax rate but also has 213 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0959 on.

However the average total tax rate in South Dakota is 5814. The state in which you live. Motor vehicles exempt from the motor vehicle excise tax under.

For additional information on sales tax please refer to our Sales Tax Guide PDF. Opt-in for email renewal and general notifications. 0 through 9 years old.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. With local taxes the total sales tax rate is between 4500 and 7500. So whilst the Sales Tax Rate in South Dakota is 4 you can actually pay anywhere between 45 and 65 depending on the local sales tax rate applied in the municipality.

7 local rate on first 1600 275. The South Dakota vehicle registration cost calculator is only an estimate and does not include any taxes fees from late registration and trade in fees. Different areas have varying additional sales taxes as well.

Missouri Car Sales Tax Calculator Missouri Cars For Sale Country Club Plaza

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Understanding California S Sales Tax

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

States Without Sales Tax Article

States With Highest And Lowest Sales Tax Rates

Pin On Form Sd Vehicle Title Transfer

Item Price 29 99 Tax Rate 6 25 Sales Tax Calculator

Sales Taxes In The United States Wikiwand

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How To Calculate Sales Tax Video Lesson Transcript Study Com

Car Tax By State Usa Manual Car Sales Tax Calculator

How Do State And Local Sales Taxes Work Tax Policy Center

Car Tax By State Usa Manual Car Sales Tax Calculator

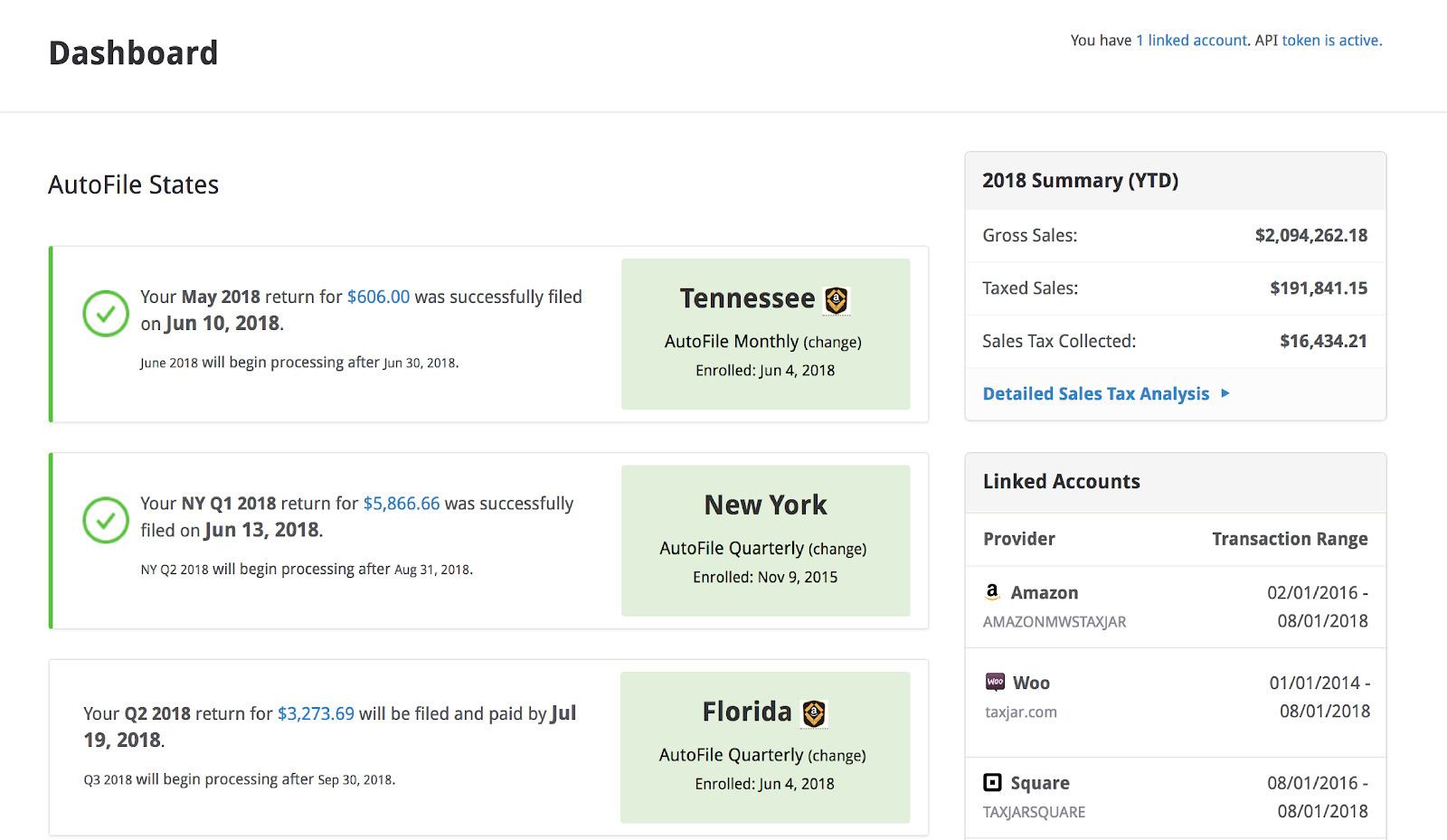

Woocommerce Sales Tax In The Us How To Automate Calculations